The Magical Metamorphosis of S Corporations Through an F Reorganization

Whether to implement a reincorporation of an S corporation, from say California to Texas, or to pave the way for an S corporation asset sale to a buyer taxed as a partnership, an F reorganization can be a tax efficient tool to achieve those objectives, among others.1

An F reorganization under §368(a)(1)(F) of the Internal Code2 is defined as “a mere change in identity, form or place of organization of one corporation, however effected.” How that change is brought about can be structured in a number of different ways.

The basic requirements of an F reorganization are as follows:3

- All of the stock of the resulting corporation (“Newco”) must have been distributed (or deemed distributed) in exchange for stock of the transferor corporation (“Oldco”).

- The same persons must own all of the stock of Oldco, as determined immediately before the reorganization, and of Newco, immediately after the reorganization, in identical proportions.

- Newco may not hold any property or have any tax attributes immediately before the reorganization, other than a de minimis amount of assets as needed under local law to facilitate the incorporation or maintain its legal existence.

- Oldco must completely liquidate, or be deemed to have liquidated, for federal tax purposes (e.g., by merger), but may retain a de minimis amount of assets to preserve its legal existence, rather than dissolve.

- Newco must be the only acquiring corporation and immediately after the reorganization Newco must be the only corporation holding property that was held by Oldco immediately before the reorganization.

- Oldco must be the only corporation acquired by Newco immediately after theReorganization and Newco may not hold property from a corporation other than the transferor corporation (if it would succeed to the tax attributes of that other corporation under § 381(c)).

Interestingly, the Regulations permit an F reorganization to occur before, within, or after other transactions that effect more than a mere change, even if Newco only has a transitory existence. For instance, a merger of Oldco into a newly formed Newco qualified as an F reorganization even though the stock of Newco was then sold by its shareholder pursuant to a prearranged plan.4 Thus, the steps of an F reorganization are tested within a bubble commencing when Oldco begins transferring assets to Newco and ending with the conclusion of the step resulting in the mere change of identity, form or place of organization.

The resulting Newco in an F reorganization succeeds to the tax attributes of Oldco. Also, the taxable year of Oldco does not close as a result of the F reorganization. Rather, Newco continues the taxable year of Oldco. Rev. Rul. 64-250 and Rev Rul. 2004-85 provide authority for the continuation of Oldco’s S election by Newco in an F reorganization by merger. While a new S election for Newco may not be necessary, a cautious advisor may nevertheless consider filing a protective S election for Newco. Whether Newco will succeed to the EIN of Oldco will depend on the nature of the transaction.

Reincorporation.

The reincorporation from California to Texas can be accomplished through the formation of Newco, a Texas corporation, followed by the merger of the California corporation (Oldco) into the Texas Newco.5 Oldco should be treated for federal income tax purposes as transferring all of its assets to Newco in exchange for Newco stock and the assumption of Oldco’s liabilities. That exchange should constitute a tax-free exchange to which §§ 361(a) and 357(a) apply. Oldco is then treated as distributing the stock of Newco to its shareholders, who should not recognize gain or loss under §354. Likewise, Newco should not recognize any gain or loss pursuant to § 1032. Such reincorporation should constitute an F reorganization so long as the F reorganization requirements are satisfied. As a result, in this reincorporation Newco should succeed to the EIN of Oldco together with the other tax attributes of Oldco.

Use of an F Reorganization to Facilitate an S Corporation Asset Acquisition.

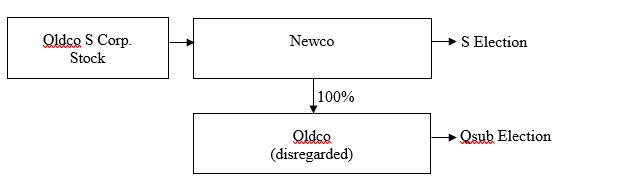

An F reorganization can also help facilitate a tax efficient purchase of the assets of an S corporation by a private equity partnership or LLC taxed as a partnership. One popular structure for such an asset purchase is for the stock of the S corporation target (Oldco) to be contributed by the shareholders to a new holding company (Newco) in exchange for stock of Newco, which makes an S election, as well as a Qsub election for the Oldco target.

Oldco Shareholders Contribute Oldco Stock to Newco

At that point Oldco should be a wholly owned subsidiary of the Newco holding company S corporation. The Qsub election results in a deemed liquidation of Oldco into Newco for federal income tax purposes, which is generally nontaxable under §332. That transaction can qualify as an F reorganization so long as the requirements listed above are satisfied. Newco must own 100% of Oldco in order to have a valid Qsub election.

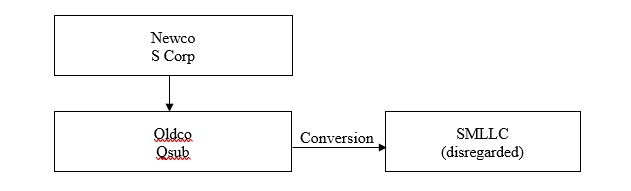

In order to facilitate the transfer of the assets of the Oldco Qsub to the purchaser (structured as a partnership or LLC) the Oldco Qsub may next be converted into a single member LLC owned 100% by Newco, pursuant to a state conversion statute. Because both the Qsub and the resulting single member LLC are disregarded entities for federal income tax purposes, the conversion should have no federal income tax consequences. Note that the timing of the Qsub election and conversion into the disregarded LLC are important. The Qsub election should have the same effective date as the contribution of stock to the holding company and S corporation election. The conversion into the disregarded LLC should be effective only after the effective date of the holding company S election and Qsub election.

Convert Oldco Qsub to Single Member LLC

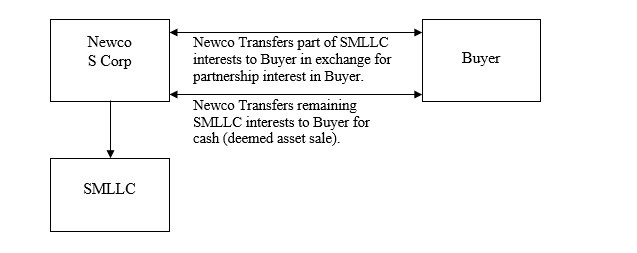

For the shareholders of the Newco holding company, the resulting structure can facilitate a partial tax-free rollover exchange of part of Holding Company’s interest in the disregarded LLC in a tax-free §721 exchange for a partnership interest in the purchaser or a parent partnership/LLC of the purchaser, if so desired. In that case Newco holding company would continue to hold the rollover partnership interest received in the exchange. The remaining interest of Newco Holding Company in the disregarded LLC can be sold to the purchaser for cash. Because the LLC is a disregarded single member LLC that part of the transaction should be treated as a partial asset sale for federal income tax purposes, for which the purchaser should get a stepped-up basis. For state law purposes the LLC should succeed to the assets and liabilities of Oldco Qsub.

Part Tax-Free §721 Exchange and Part Sale

For the purchaser, the purchase of interests in the LLC may help insulate it from certain lingering S corporation issues, including whether there was a valid S election in place. However, the purchaser may still have potential transferee liability exposure. The transfer of LLC interests can also simplify the transfer documentation by eliminating the need for extensive asset transfer documents, lessor consents, etc.

Unlike the reincorporation, in this transaction the Newco holding company will have to obtain a new EIN because Oldco will be required to retain its historic EIN even though it is a disregarded entity.6

While a sale of S corporation stock coupled with a §338(h)(10) election or §336(e) election is also treated as an asset purchase for federal income tax purposes, those alternatives do not permit a partial tax-free rollover exchange by the seller for an interest in the purchaser entity or its parent, taxed as a partnership.

For any questions regarding the use of F reorganizations in corporate transactions please contact Tom Hineman at thineman@meadowscollier.com, or (214) 744-3700.

_____________________________

1 While F reorganizations can also be used with C corporations, an F reorganization is particularly well suited for a variety of transactions involving S corporations.

2 All section references herein, other than to Regulations, are to the Internal Revenue Code of 1986, as amended.

3 Reg. § 1.368-2(m)(1).

4 Reg. § 1.368-2(m)(4), Ex. 6.

5 Rev. Rul. 64-250, 1964-2 CB 333.

6 Reg. §301.6109-1(i); see Rev. Rul. 2008-18