ERC Voluntary Disclosure Program Revived

-

Jeffrey M. Glassman

Jeffrey M. Glassman

View Bio

On August 15, 2024, the IRS announced that they are opening a new ERC Voluntary Disclosure Program (VDP). The new program is similar to the first iteration of the program. Employers will be able to correct improper payments at a 15% discount (previously 20% discount). Applications must be submitted by November 22, 2024—approximately 3 months from now. Payment will be due after the IRS accepts the application, contacts the business to go over the application and ask any questions, and sends the business a closing agreement to formalize the business’s participation in the program.

Unlike the prior ERC VDP, this program is available only for 2021 tax periods. The IRS made clear that this program is not available to disclose and repay ERC money from tax periods in 2020.

Even if a business is unable to fully pay 85% of the credit, the IRS may consider businesses for an installment agreement on a case-by-case basis. However, be warned, the IRS has made clear that businesses that do not fully pay the 85% amount at the time they finalize their ERC closing agreement, will be liable for penalties and interest in connection with an alternative payment arrangement.

Similar to the prior ERC VDP, businesses must provide the IRS with names, addresses, telephone numbers, and details about the services provided by any advisors or tax prepares who advised or assisted with their claims. Other requirements to participate include:

- The employer hasn’t already applied to the first ERC VDP for the same tax periods. The IRS is still processing VDP applications from the first program. Taxpayers should not reapply for the same periods.

- The employer isn’t under criminal investigation.

- The employer isn’t under an IRS employment tax examination for the tax period for which they’re applying to the VDP.

- The employer hasn’t received a Letter 6577-C, Employee Retention Credit (ERC) Recapture, or an IRS notice and demand for repayment of part or all of its ERC claim.

- The employer hasn’t already filed an amended return to eliminate their ERC.

- The IRS hasn’t received information from a third party or directly from an enforcement action that the taxpayer is not in compliance.

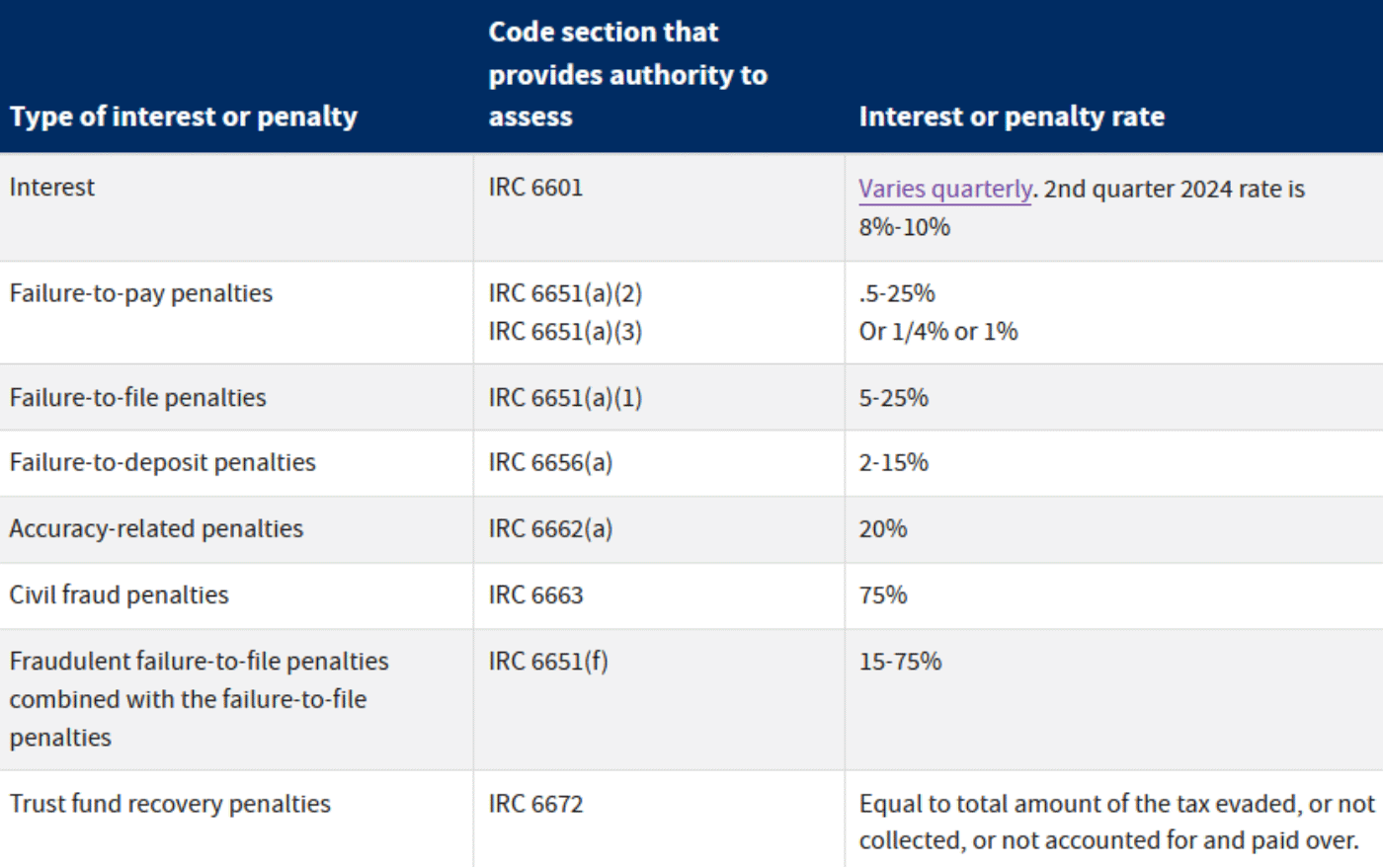

The IRS has provided a Frequently Asked Questions (FAQs) about the new ERC VDP (link). In the FAQ, the IRS provided a list of civil interest and penalties that could apply depending on a business’s particular facts and circumstances. That table is copied below.

If you have any questions about the new ERC VDP, including whether this program is right for your business, please contact me at 214-749-2417 or jglassman@meadowscollier.com. I am more than happy to discuss any ERC or other civil or criminal tax issues.