IRS Voluntary Disclosure Program Now Squarely Looks at Virtual Currency Issues and Provides Additional Clarity for Penalty Structure

-

Jeffrey M. Glassman

Jeffrey M. Glassman

View Bio

On February 15, 2022, the IRS announced that it had changed its form (Form 14457) for making a voluntary disclosure with the IRS. We previously wrote about the IRS voluntary disclosure procedures here and here. A link to the revised voluntary disclosure form can be found here.

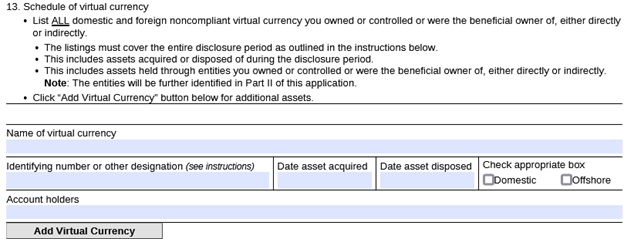

Changes include a separate section for reporting virtual currency issues. Below is an image of the new section of the IRS form.

This, in addition to the IRS’s numerous public comments, demonstrates the IRS’s laser focus on virtual currency issue enforcement.

The revised Form 14457 instructions now also include more clarity regarding the penalty structure for certain disclosures.

For employment tax issues, the instructions state that a civil fraud penalty (75%) or fraudulent failure to file penalty (75%) will apply to the highest quarter of employment tax liability. This penalty is in lieu of accuracy related penalties and late-filing and late-payment penalties.

For estate tax issues, a civil fraud penalty or fraudulent failure to file penalty will also apply, but the IRS has reduced the penalty amount to 50%, rather than 75%. The penalty will apply to the deficiency in estate tax.

For gift tax and generation-skipping transfer tax issues, a civil fraud penalty or fraudulent failure to file penalty will apply, but the IRS has reduced the penalty amount to 50% for disclosures that involve only one year. The penalty will apply to the deficiency in gift tax and generation-skipping transfer tax. Notably, the usual 6-year disclosure period for a voluntary disclosure does not apply to gift tax and generation-skipping transfer tax issues if the disclosure includes multiple-year issues. The IRS is requiring taxpayers to submit original and/or amended returns for all years. For multiple-year issues, the 75% penalty will apply to the year with the highest deficiency and no accuracy-related penalties will apply to the other years.

Other changes to the Form 14457 include the IRS allowing for photocopies, facsimiles, and scans of taxpayer signatures. The IRS is also now allowing Part II of the form to be faxed to the IRS, in lieu of the prior requirement to mail the form.

For questions regarding this article or any criminal or civil tax matter, please contact Jeffrey M. Glassman at 214-749-2417 or jglassman@meadowscollier.com.