The IRS Compounding Interest Rate is 7%: Should You Make a Deposit or Advance Payment Now?

By Josh O. Ungerman on January 4, 2023

-

Josh O. Ungerman

Josh O. Ungerman

View Bio

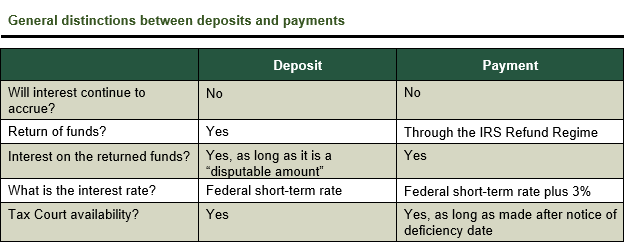

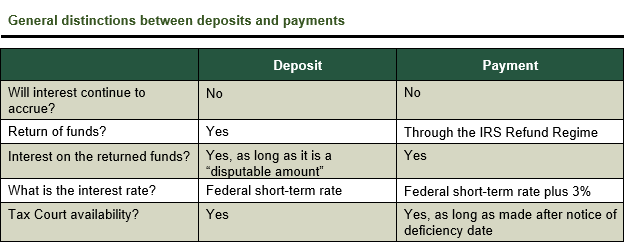

The IRS will charge interest on any amount of tax ultimately due. For taxpayers wanting to stop the accrual of interest before the liability is paid, some or all of the proposed deficiency can be deposited or paid to the IRS while the controversy continues. When interest rates are low, taxpayers often choose to keep their money and invest it in a way that generates a return greater than the IRS interest rate. Things are beginning to change, however. In January 2023, the underpayment interest rate rose to 7%. Thus, it makes sense for the taxpayer to at least consider making a deposit of some or all of the proposed additional taxes and stopping the accrual of interest. While doing so would of course force the taxpayer to part with the money, any amount of the payment ultimately returned to the estate at the conclusion of the litigation would come with interest paid by the IRS. The amount of interest paid by the IRS depends on whether the taxpayer makes a deposit or a payment. If the taxpayer makes a deposit, the interest rate is the federal short-term rate (currently 4%), but the tradeoff is that the IRS is required to return a deposit to the payor upon request. In contrast, if the taxpayer makes a payment, the interest rate is the federal short-term rate + 3% (currently 7%). However, once made, a payment cannot be returned upon request but instead must be recouped using the IRS refund regime.

Please see the chart below generally addressing the payment versus deposit options:

If you have any questions regarding this blog post or any other civil or criminal tax-related matter, please feel free to contact Josh Ungerman at (214)749-2427 or jungerman@meadowscollier.com.

Please see the chart below generally addressing the payment versus deposit options:

If you have any questions regarding this blog post or any other civil or criminal tax-related matter, please feel free to contact Josh Ungerman at (214)749-2427 or jungerman@meadowscollier.com.